Down Payment Strategies for First-Time Homebuying: Real Estate Blogs in Toronto

The phrase “down payment” brings up images of uncertainty and weighty financial consequences in the real estate world. But before you start the fulfilling path of homeownership, you have to understand the meaning and importance of down payments. In this article, In this Real Estate Blogs in Toronto article, I will try to explore the topic of down payments, clarifying its complexities and helping you to handle this vital component of real estate deals. In the end, I will try to explain how Forhad Reality can help you to arrange a down payment.

A down payment is a portion of the total amount paid upfront for a costly item, such as a house or automobile, or any kind of luxurious goods u want to purchase. It shows the buyer’s commitment to the purchase and is usually indicated as a percentage of the entire purchase price. A loan is used to finance the remaining amount.

Let’s simplify it for you:

Let’s say you’re buying a car that costs $20,000. You decide to put down a 20% down payment, which is $4,000. This means you will finance the remaining $16,000.

Let’s say you’re buying a house in Toronto that costs $300,000. You decide to put down a 10% down payment, which is $30,000. This means you will finance the remaining $270,000.

A Quick Overview of Down Payment Amounts by Purchase Price

| Purchasing Price in CAD | 5% Down Payment in CAD | 10% Down Payment in CAD | 20% Down Payment in CAD |

| $500,000 | $25,000 | $50,000 | $100,000 |

| $600,000 | $30,000 | $60,000 | $120,000 |

| $800,000 | $40,000 | $80,000 | $160,000 |

| $100,0000 | $50,000 | $100,000 | $200,000 |

In short, you will need to finance a smaller loan amount the larger the down payment. A shorter loan term and reduced monthly payments could result from this.

Despite the current market conditions, there are several down payment options available in the Canadian real estate market. Here are some options to consider:

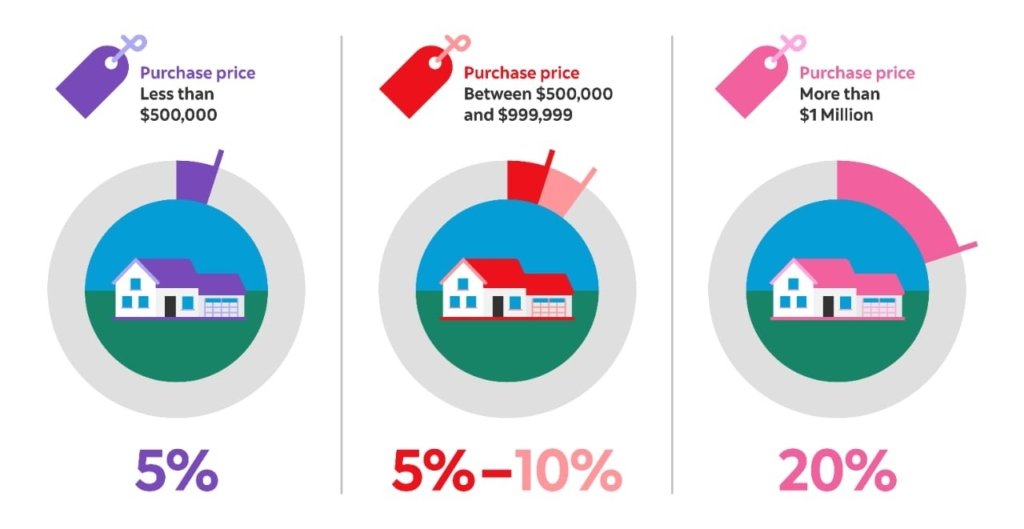

Minimum Down Payment:

| Home Value | Minimum Down Payment |

| Under $500,000 | 5% |

| $500,000 – $1 million | 5% on first $500,000 + 10% on remaining |

| Over $1 million | 20% |

Looking for more similar real estate blogs in Toronto that can give you a lot of insights? Please consider booking my blog, where I share insights on the Canadian real estate market.| Program | Description |

| Canada’s First-Time Home Buyer Incentive (FTHBI) | Provides a 5-10% down payment to qualified first-time homebuyers. |

| RRSP Home Buyers’ Plan | Allows first-time homebuyers to withdraw up to $35,000 from their RRSPs for a down payment. |

| Option | Description |

| Borrowed funds | May be available from personal loans, lines of credit, or equity from existing assets. |

| Gifts | Family members can gift you money towards your down payment. |

| Down payment assistance programs | Available in some provinces and municipalities for specific groups of buyers. |

I can offer a range of services and guidance to help borrowers overcome this financial hurdle and achieve their dream of owning a home for them.

Many people have a dream of buying a home in Toronto, but the financial obstacles—particularly the down payment—can seem stressful. Remain committed to your goal of becoming a homeowner even if you’re having trouble saving for a down payment.

I understand the challenges of saving for a down payment, that’s why I’m here to help you. I want to make homeownership more affordable for everyone.

Get in touch with me today let’s discuss how I can help you achieve your dream of homeownership.

Make a call: +1 647-667-7256

Don’t forget to follow my social media pages such as Facebook and Instagram where I share daily tips.